Paubox Presentation at 500 Startups in SF

I am not an expert in fundraising. It is one of the hardest parts of my job as Founder CEO of Paubox, Inc.

About Paubox

- Our company has raised a small amount of capital to date (under $500K).

- I have closed small amounts of funding in both Hawaii and Silicon Valley.

- We are lucky enough to have found product/market fit.

- We are a digital health B2B SaaS (Software as a Service) startup.

- We moved from Hawaii to San Francisco two years ago.

- We provide the easiest way to send and receive HIPAA Compliant Email.

We believe U.S. healthcare is the last American business segment to use email in the workplace.

SEE ALSO: Silicon Valley Bank 2017 Fundraising and Startup Outlook

Pitch Workshop: The Difference between Pitching in Hawaii and Silicon Valley

With that in mind, I was asked today to participate in a pitch workshop called Powerful, Persuasive Pitch. It was hosted by the High Technology Development Corporation (HTDC) and Mark Tawara. My friend Len Higashi initially reached out and asked for my thoughts on the "difference between pitching in Hawaii and Silicon Valley." Len mentioned some of the companies back home wanted to hear from Hawaii startups who have done it in Hawaii and the Mainland (contiguous U.S.). He also asked me to cover things I have seen in both markets.

Things I Remember about Pitching in Hawaii

- Very small pool of angel investors and an even smaller pool of VC's.

- Hawaii investors are generally on time.

- The abrupt end to Act 221 continues to have an adverse effect on the investment community (IMO).

- Constricted deal flow.

- Accelerators like Blue Startups, XLR8UH and Energy Excelerator are providing a lot of value to Hawaii's rebooted startup scene.

Things I have seen Pitching in Silicon Valley

- Immense pool of VC and angel investors.

- VC's seem to be traditionally late. I have been late twice to investor meetings; vice versa happens much more often.

- Associates can be as helpful as Partners in a VC firm.

- FOMO is everywhere.

- If you haven't had an exit or didn't go to an elite college (i.e., Stanford or Ivy League), it can be a tough slog.

Similarities Between Fundraising in Hawaii and Silicon Valley

- Fundraising is a full-time job that cannot be delegated. A founder or co-founder must do it.

- Be prepared for a lot of no's. Over 100 no's is common.

- Treat it like a sales funnel. Do you have a CRM for tracking investor leads?

- You will have many derivatives of your pitch deck.

- Get the money in your account before you celebrate. It's going to take longer than you think.

- Try to pack your meetings into a tight window (a couple weeks). I struggle with this myself.

SEE ALSO: Brushing Up Our SaaS Metrics in Silicon Valley

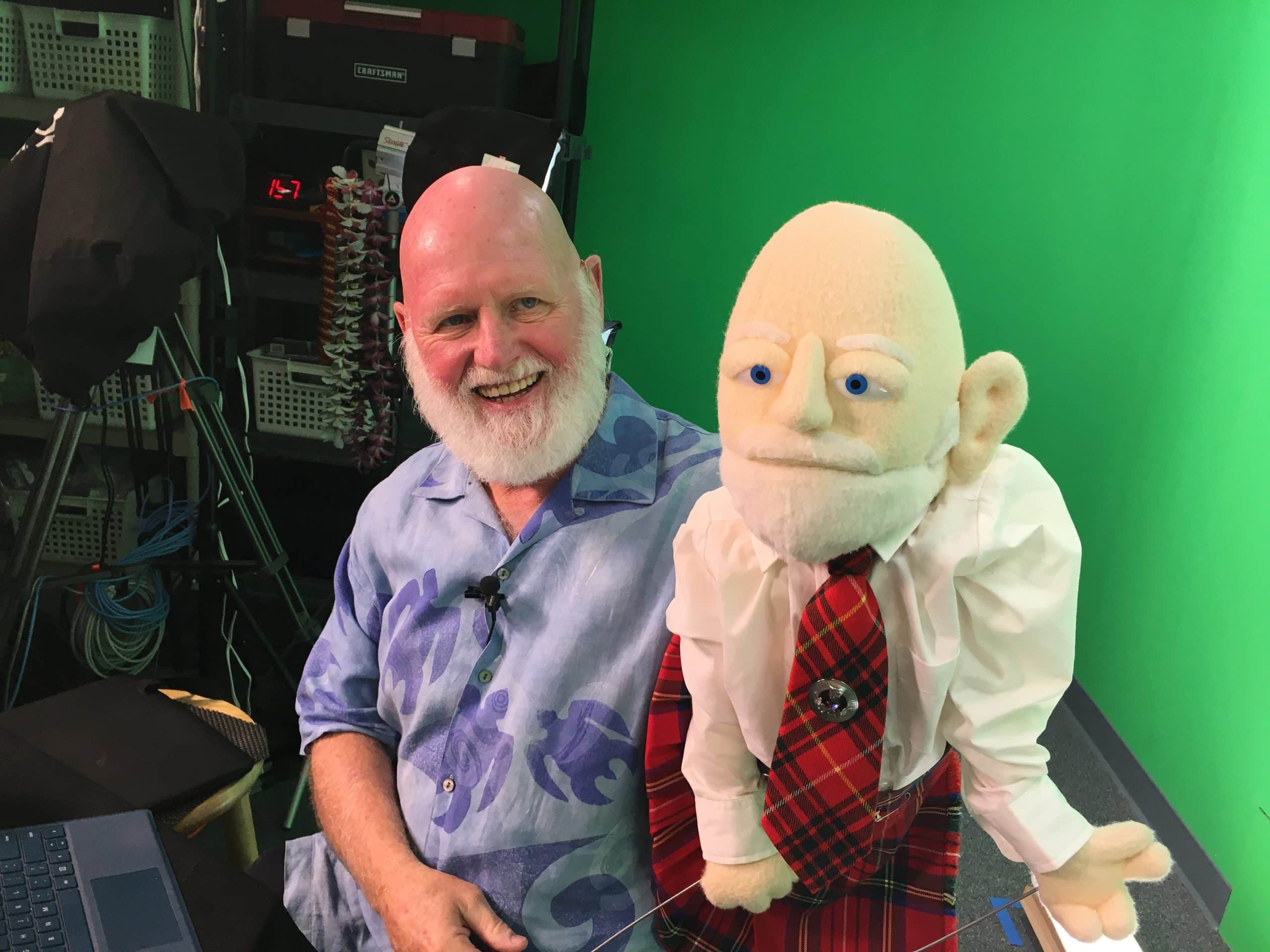

Eric Nakagawa: Paubox Investor, Adviser and Trusted Friend

Eric Nakagawa: Paubox Investor, Adviser and Trusted Friend

I hope this post provides value to you.

Aloha from SF,

Hoala Greevy

Founder CEO

Paubox, Inc.

Subscribe to Paubox Weekly

Every Friday we bring you the most important news from Paubox. Our aim is to make you smarter, faster.

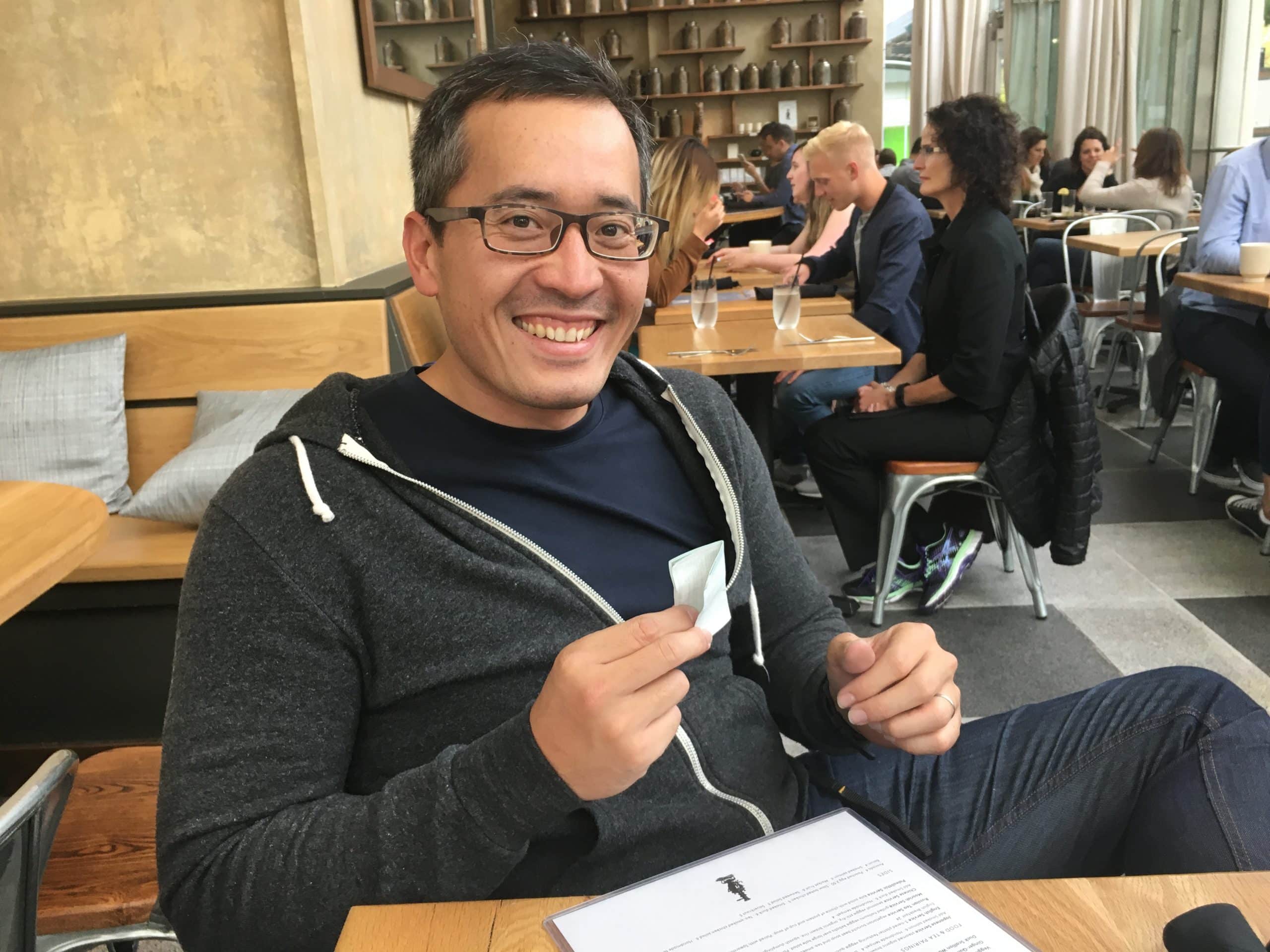

Hoala Greevy

Hoala Greevy