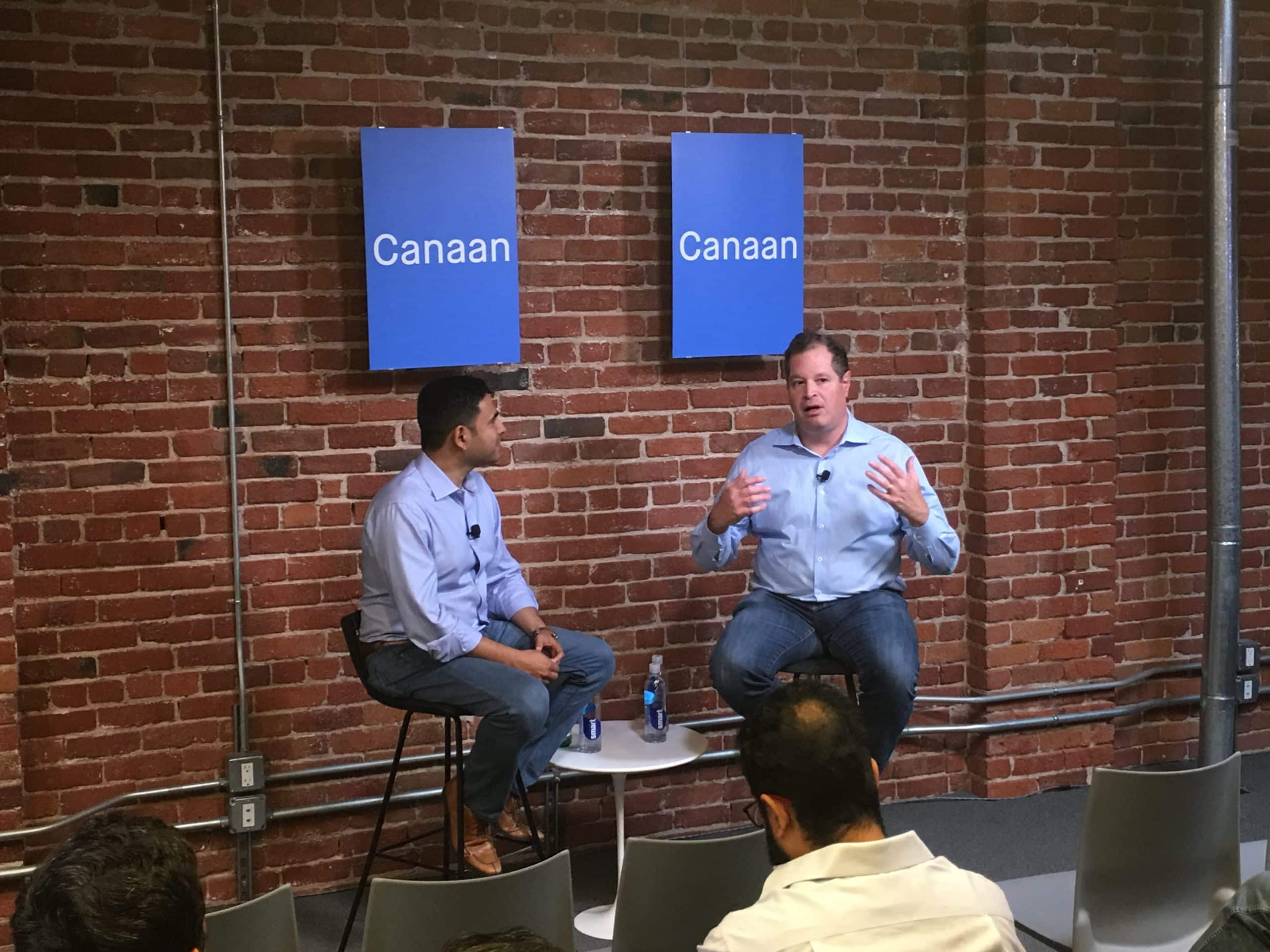

Joydeep Bhattacharyya (Canaan Partners) and John Somorjai (Salesforce Ventures) After a busy day at the office and taking meetings yesterday, I hustled over (i.e., took an Uber) to the Canaan Partners office in South Park. As far as tech goes, South Park is a tony part of SF. The topic: Thinking M&A the Salesforce Way - Fireside chat with Salesforce's John Somorjai and Canaan's Joydeep Bhattacharyya on what's driving recent acquisitions like MuleSoft. Before the event started, I made some new connections and caught up with familiar faces. There's no other way around it, you gotta show up to make things happen.

Thinking M&A the Salesforce Way: My Takeaways

Here are my takeaways from last night's fireside chat at Canaan Partners:

- 15% of Salesforce employees come from acquisitions.

- Salesforce Ventures: 218 companies in portfolio. 11 of which have been acquired by Salesforce.

- Customer success team is very important on the back end.

- They view themselves as strategic investors on the venture side.

- Salesforce Ventures rarely leads. They average one investment per week (Wow).

- MNA is tough now (IPO market is opening).

- It's incredibly stressful to buy a public company.

- “Speed is everything.”

- Salesforce needs core group of leaders to be incentivized to stick around after acquisition.

- They are focused on buying companies that can hit $100M ARR within 12 months.

- “If you’re building a $10M or $20M business in Salesforce, no one cares.”

- Be upfront and transparent when meeting with CorpDev.

- “We know every company has issues. We have issues.”

- “Trust is so core to our value as who we are as a company.”

- Customer attrition (churn) is so crucial in a SaaS company.

- There’s only a handful of companies that will want to buy your company.

- A big reason Salesforce acquired Mulesoft: Because Mulesoft is playing a big role in helping customers go thru digital transformation.

- Salesforce had been customer and investor in MuleSoft since 2013.

- Be involved in DreamForce and AppExchange to get on Salesforce radar.

- “Spending one week at Dreamforce is incredibly valuable in terms of understanding our strategy.”

- Snapchat uses Quip as a verb within their company.

- From the top, Marc Benioff forces the product teams to think about what to build vs. what to acquire.

- John is on the board of National Venture Capital Association.

- Immigration is a hot button for NVCA right now.

- If IPO window closes, M&A activity could pick up.

- Re: SaaS: “The fundamentals of the industry are fantastic...This is the future of the software industry.”

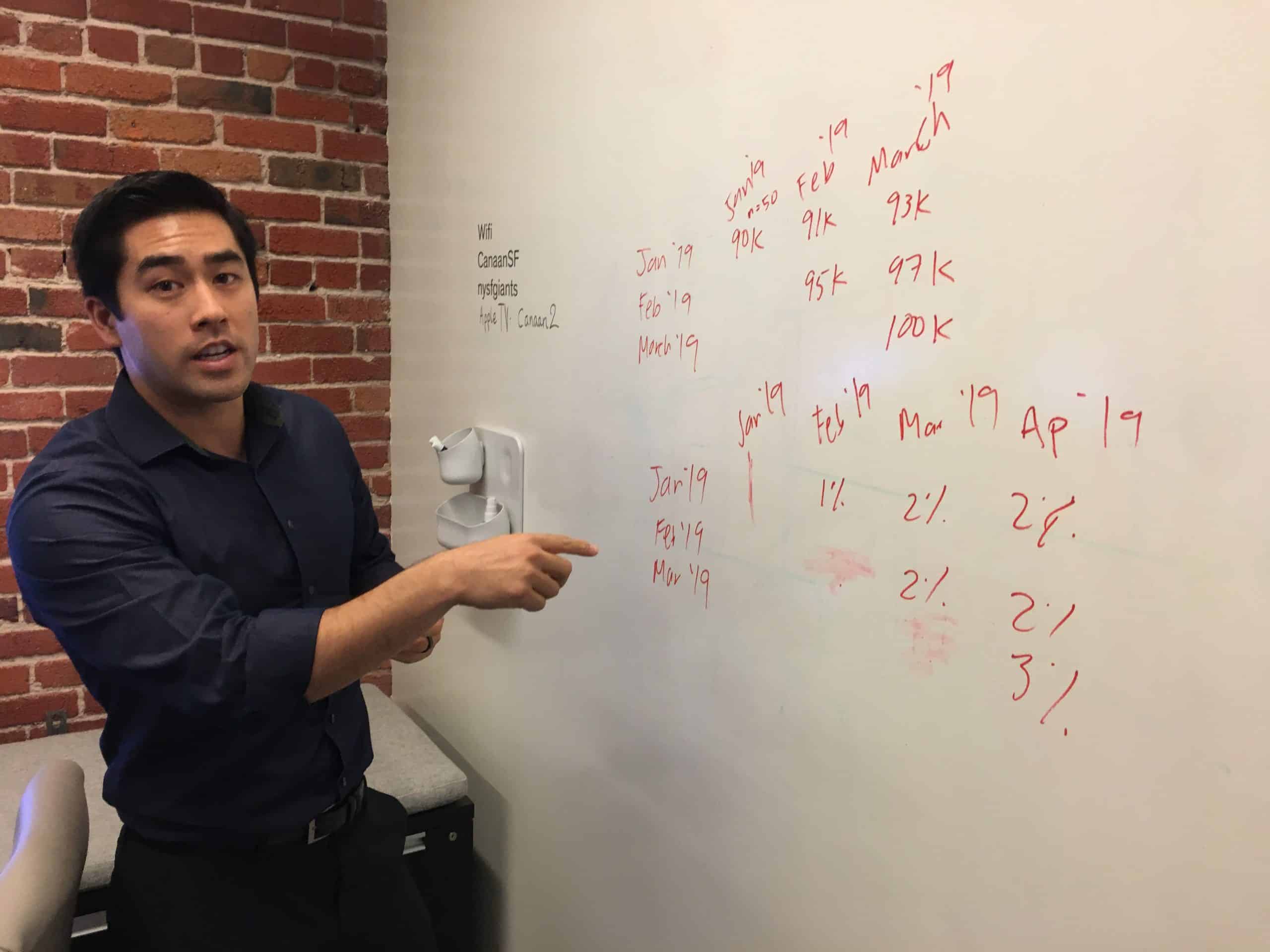

Rayfe Gaspar-Asaoka (Canaan Partners)

Selfie with Rayfe Gaspar-Asaoka Mahalo to Rayfe Gaspar-Asaoka for the invitation to last night's event. Rayfe has been keenly helpful to us since we met in 2016. See you later today, Rayfe! SEE ALSO: Brushing Up Our SaaS Metrics in Silicon Valley

Subscribe to Paubox Weekly

Every Friday we'll bring you the most important news from Paubox. Our aim is to make you smarter, faster.

Hoala Greevy

Hoala Greevy